There is only one real crisis in Australia that could actually make Albanese a one-term wonder. Not the Voice, not climate change, not even cost-of-living per se. No – it’s the housing affordability catastrophe.

It is a catastrophe that now, for the first time in many years, extends to both renters and owners. The mortgage belt are feeling the pinch of the roughly eight billion letters that they’ve been sent by their banks notifying them of increases to their monthly repayments, and renters are feeling the “pinch” of 30-40% increases in rent as landlords pass on the interest rate increases like a hot potato.

Unfortunately for Anthony Albanese, the housing crisis can’t be solved with wistful speeches about how he grew up in government housing. Actual reform is required. And we’re talking about historically one of the hardest types of reform – land reform.

The difficult thing about this catastrophe is that it comes off the back of three decades of policy inaction, so it’s hard to see how it can be fixed by the time the election rolls around in May 2025. Luckily I have an easy one-step solution.

But before I reveal my one-step solution, let’s first of all talk about the current solution to Australia’s housing affordability catastrophe.

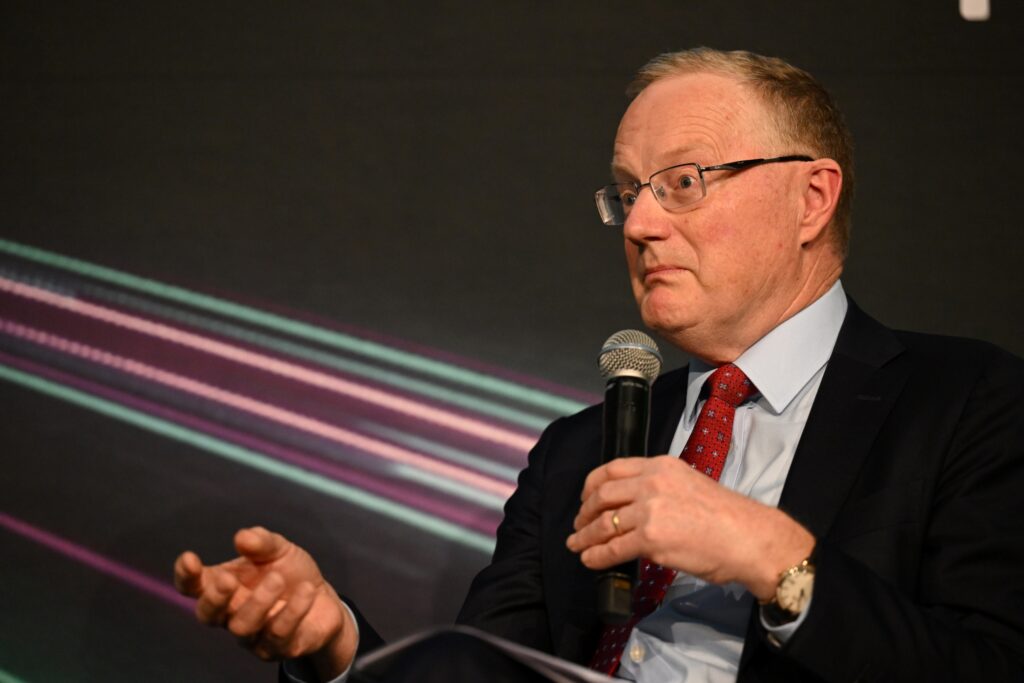

It is a solution eloquently outlined by Philip Lowe, Australia’s biggest banker. In 2017, he made a speech in which he noted the incredibly close correlation between interest rates and housing prices. Essentially it was an acknowledgement that his job (setting interest rates) was the primary determinant of housing affordability.

Fast forward four years later to September last year, and he was asked at a parliamentary committee about the fact that nobody under 35 can afford a house anymore. Suddenly, it wasn’t interest rates that was causing the catastrophe, but lack of planning by state governments: “the inability to address zoning, taxation and transport has really negative effects, longer-term effects on the society but that’s not my day job”.

His solution to the price of houses in Australia is literally that people should inherit a house from their parents. That’s right, boomers, the biggest banker in Australia has a plan to solve housing, and it’s to wait for you all to die.

But don’t worry, he’s not a monster. When asked about whether he’s worried about people who can’t access the good old Bank of Mum and Dad, he professed that, “I worry a lot about that”. But not as the biggest banker in Australia, just as “an Australian”. You see, the housing crisis as Lowe sees it, isn’t really an RBA problem, despite the fact that he acknowledged in 2017 that he literally sets house prices. Apparently, worrying about that stuff is not his job. It’s more of a hobby.

Under Lowe, the RBA’s solution to soaring rents is even more macabre. The plan is to treat rents like any other consumer good. The only plan they ever have when prices are soaring is to jack up interest rates so high that demand in the economy falls away, and prices stabilise. In other words, make everyone so tight with their money that a section of people can no longer afford to house themselves, and rental demand wanes. Of course, that’s just Monetarism 101, but the fact that Mr Lowe hasn’t clocked what a profoundly stupid plan that is makes his position untenable.

Housing is actually not like other consumer goods such as TVs or sunglasses or inflatable pool toys or even avocado toast. It is actually a basic human necessity. But that subtlety of thought apparently eludes our biggest banker.

So, I think we can all agree that an easy first pre-step in my one-step solution is to get rid of Philip Lowe. I know everyone deserves steady employment, but I’m sure he can rent out the front room of his $4 million Randwick house if he falls upon tough times. It’ll be more help to the rental crisis than anything else he’s done so far.

Anyway, on to my solution. Please note that this is the result of almost half an hour of brainstorming on the topic – which doesn’t sound like a lot, but is definitely more than most governments over the past thirty years have given it. And it’s certainly not just the first solution that sprang to mind. (The first idea was to concrete over Sydney Harbour, thereby solving the problem of soaring prices of harbour-front properties, by eliminating harbour-front properties, and freeing up a lot more space for apartment blocks to be built, especially directly in front of Point Piper mansions.)

No, the solution is this. At the moment there are two ways to own property in Australia. There’s torrens title, or “freehold”, which is basically that you just own the property outright. And then there’s strata title, where you own your apartment or townhouse, but you still get to have endless arguments about garbage room etiquette with your neighbours.

The problem is that both of these types of title commodify homes. It makes the housing market just like any other part of the economy. Homes, from an economist’s perspective, are subject to the same macroeconomic policy as TVs and sunglasses and pool toys and avocado toast.

Australia needs a third form of property title, that recognises that homes are not like other assets. Let’s call it “Owner Occupier Title”. The idea behind this title is that you can’t buy an Owner Occupier Title apartment and then rent it out. You have to live in it. None of the tax benefits of renting apply to this form of property. You can’t negatively gear “owner occupied” title. You can’t deduct the cost of interest payments against your rental income. It is a home that must be used as a home, not an asset. And if you need to move, you have to sell it.

It goes without saying that this type of property would be worth less than freehold or strata. There would be no demand from investors. Instead, only people who want to live there would be bidding for these homes. How revolutionary!

So why would any property developer build them?

Firstly, it is common for planning authorities to require a set percentage of a development to be “affordable housing”. Unfortunately, because that affordable housing is sold under existing strata title, it is instantly commodified and the prices soar. Thus “affordable housing”, especially in the inner suburbs, is actually just really fucking small housing. Tiny one-bedroom apartments for you and your low-income family to squeeze into. What a brilliant policy. Instead, under this solution, planning authorities would require a set percentage of new developments to be Owner Occupier Title. Dwellings that are homes, not investment assets.

And having a title that is dedicated to funding homes (rather than housing assets), would allow you to at last have some macroeconomic policy with a bit of finesse, that isn’t simply the moronic Monetarism 101 that we’ve had for the past three decades.

The RBA could have two interest rates. The cash rate, and an owner-occupier housing rate. That rate would be made available to banks to fund the building and ownership of Owner Occupier Title properties. And the RBA’s goal for this second type of interest rate could be house price stability. The idea that the price of a home should neither fall nor increase.

A lot of things then naturally flow from this one step solution. State governments could chip in by eliminating stamp duty on this type of property, and instead having an annual property tax. This would make the transaction costs of selling every time you moved less onerous, and eliminate a stupid tax.

Transport projects could require minimum levels of Owner Occupier Title around transport hubs to make sure housing stayed affordable even as suburbs are upgraded. First home-buyer support could be targeted at Owner Occupier Title dwellings.

The mythology of Australia is that we all own our own homes, but actually 30% of people don’t. In Australia, renting is a precarious affair, where your ongoing shelter is almost entirely at the whim of a private landlord. The maximum length of assurance one can hope for when renting is 12 months of stability.

We have a system that is forcing many people to uproot their entire lives and move rental properties every year or two because they happen to not have parents willing to die early enough. As famed socialist Robert Menzies understood, this is not the basis for a stable political system.

Housing affordability is a sneaky crisis because no one in charge of fixing it is suffering from it personally. No commentator traipsing off to Canberra last Sunday for another week in the bubble has been personally forced out of their house at the whim of the landlord in recent months.

Everyone in Canberra knows that, statistically speaking, it is a crisis, but it seems so complicated that nobody even knows where to start. Well, the ideal time to start de-commodifying our housing market was thirty years ago, but the next best time is to start today. The government should start by sacking Philip Lowe, and then implementing some proper land reform in Australia. Come on, Albo – it would make Menzies proud.